The workhorse of Russia’s drone fleet — responsible for crippling Ukraine’s energy grid and triggering a humanitarian crisis — is built with EU technology. Despite tightening sanctions, parts for the Geran-2 are still flowing into Russia with ease, writes OCCRP.

It’s freezing in Tetiana Kavinova’s apartment in the eastern part of Kyiv, a sprawling expanse of residential districts locals call the Left Bank. Each night, like hundreds of other buildings in the Ukrainian capital, hers descends into icy darkness. Kavinova’s electricity and heating has not worked reliably since Russian kamikaze drones started repeatedly hitting the city’s power plants in early January.

This campaign against Ukraine’s energy infrastructure is Moscow’s most recent attempt to weaponize the winter cold. Over a million Ukrainians have endured weeks without power, water, or heat.

“I wish it was evening so I could fall asleep and forget,” Kavinova says to a reporter from OCCRP’s local partner, the Kyiv Independent. “Yesterday, I was lying in bed, thinking about putting on gloves. You lie under two or three blankets and don’t get up.”

But it’s not only Russia to blame for this man-made humanitarian crisis. Despite EU sanctions that prohibit direct exports, hundreds of components produced by European companies are still ending up in its drones.

Among these is the Geran-2, a cheap model that can deliver its deadly payload across thousands of kilometers. Striking Ukrainian energy infrastructure and other civilian targets by the hundreds, night after night, these drones are produced at an industrial scale that requires a steady supply of foreign parts.

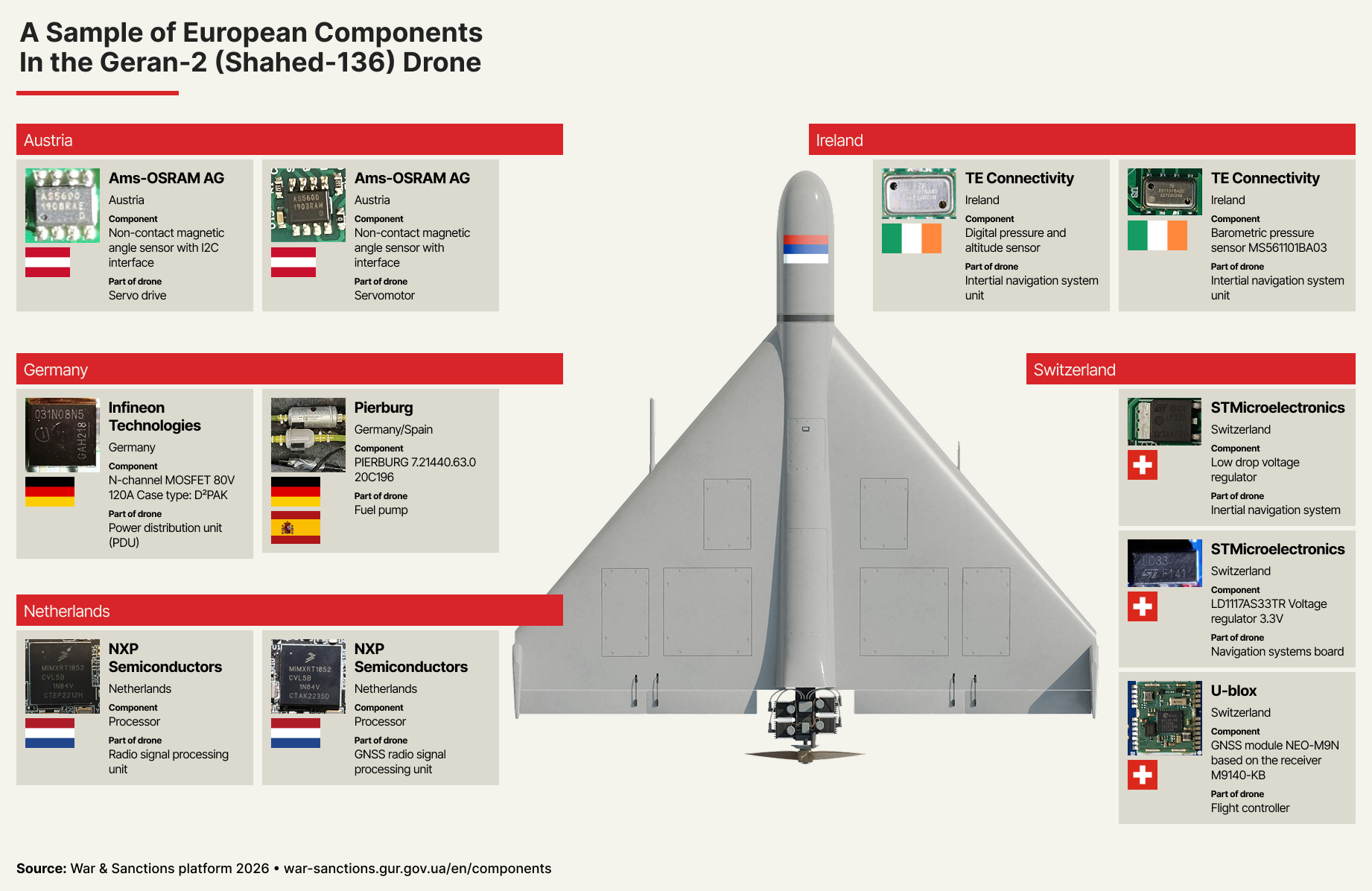

By dissecting the charred remains of downed Geran-2 drones, Ukraine’s military intelligence agency has been able to map out the anatomy of this model and the components that go into it. Though some are published on the agency’s specialized website, reporters have obtained exclusive documents that provide a fuller picture of which foreign parts are enabling Russia’s campaign of winter terror.

The total number of components is in the hundreds, of which only a few dozen are of Russian origin. Many are produced by companies from the United States and China, but over a hundred are produced by about 20 European firms. The items include microchips, receivers, transistors, diodes, antennas, and a fuel pump.

The European Union forbids the direct export of many of these items to Russia. But trade data obtained from the Import Genius platform shows 672 shipments of sanctioned components produced by these European firms being sent to the country between January 2024 and March 2025. The shipments originated from 178 companies, mostly in China and Hong Kong.

There is no indication that any of the European manufacturers named in this story violated any legislation or had anything to do with these sales. But these findings illustrate the extent to which the steadily-tightening EU sanctions regime has failed to restrict Russia’s ability to manufacture drones with foreign components.

About the Collaboration

In a statement to reporters, David O’Sullivan, the EU’s Chief Sanctions Envoy, wrote that tackling sanctions circumvention is a “key priority” for the European Union and that recent sanctions packages have “added tools” to support member states to do so.

“We will not ignore cases of our sanctions being systematically circumvented through the jurisdictions of third countries,” he wrote. “This is why, in my role as Sanctions Envoy, I have been actively engaged in outreach with third countries to prevent that their jurisdiction would be used for the sale, supply, transfer or export to Russia of these specific high-risk goods of EU origin.”

The European Manufacturers

‘The poor man’s cruise missile’

According to the Ukrainian Air Force, there were only nine days in all of 2025 when Ukraine was not struck by Geran-2 drones. A total of 34,000 targeted the country over the course of the year, making up more than half of all drone attacks.

These swarms of drones, often hundreds at once, are a bid to confuse and weaken Ukrainian air defenses, often allowing more destructive missiles to pass through the gaps. The United Nations has documented 682 civilian casualties from long-range weapons in 2025 alone.

In Ukraine, the Geran-2 is universally known as the “Shahed,” a reference to its Iranian origin. Today, most are produced in a factory in the Russian republic of Tatarstan. Reportedly costing just $20,000 to $50,000 apiece, their affordability, low-altitude flight profile, and self-destructive design has earned them the nickname “the poor man’s cruise missile.”

“The Shahed is the only drone that can strike at a strategic depth of up to 2,500 kilometers,” says Ivan Kirichevsky, a serving member of the Ukrainian military and a weapons expert at Defense Express, a Kyiv-based think tank. “If we consider literally all known drones of a similar class in the world — meaning long-range kamikaze drones — the Shahed and its derivatives are truly the best.”

The Geran-2 has also been cited as a strategic concern for the European Union. Officials have pointed to repeated violations of Romanian airspace, and the drone’s success at overwhelming air defenses in Ukraine, as signs of a growing threat and a key driver behind new counter-drone initiatives.

In an attempt to cripple Russian weapons production, the European Commission banned all export of so-called “dual-use goods” to Russia and Belarus in 2022. This definition covers products, software, or technologies that are designed for commercial applications but may also be used for military purposes. The United Kingdom and Switzerland, which are not EU members, implemented similar restrictions.

As the war continued, EU sanctions tightened, broadening restrictions and starting to include legal entities in third-country re-export hubs that were suspected of enabling circumvention. The European Commission added a new layer of legal accountability in 2024, requiring EU firms to include a «no re-export to Russia» clause in contracts with foreign clients.

“Sanctions work,” said Vladyslav Vlasiuk, Ukraine’s Sanctions Commissioner under President Zelenskyy. “Take the example of cruise missiles. Russia would love to scale up production, but they couldn’t. Why couldn’t they? Because they couldn’t get the required Western parts. Why couldn’t they get that? Because of sanctions.”

“Without Western technologies,” Vlasiuk says, “Russia would not be able to produce the Geran-2.”

Global Supply Chains

To see how sanctioned items still end up in Geran-2 drones, reporters traced the path of one of their key components — a GNSS receiver. This device, which is also used to enable GPS systems in consumer devices like smartphones, provides drones with precise positioning, velocity, and time data derived from satellite signals.

For the Geran-2, this part is manufactured by u-blox, a Swiss firm that specializes in radio modules and positioning products.

In a statement on its website, the company “strongly condemns” Russia’s invasion of Ukraine and notes that it stopped all sales to Russia, Belarus, and occupied Ukrainian territories immediately after the invasion. It also says that it no longer sells to the countries of the Eurasian Economic Union, which have a free trade agreement with Russia, and has a “strict company policy” not to allow its products to be used in military drones.

Yet u-blox parts have made their way to Russia from companies around the world.